An additional 3 is. The day your net tax owing for the year is due although interest still applies if there is an overdue balance on your.

3 12 106 Estate Tax Returns Paper Correction Processing Internal Revenue Service

GST should be accountable at standard rate 6 on the value of supply up to 31 May 2018.

. Fine not exceeding RM30000 or imprisonment not exceeding 2 years or BOTH. Since 1 January 2017 the RMCD has adopted a very strict position on late payments and the RMCD. Penalties Late Payment of GST.

Late GST Payment Penalty is 5 within 30 days and an additional 5 after 30 days yet not exceeding 60 days. In accordance with amendments made to Section 41 of the Goods and Services Tax Act 2014 with effect from 112016 failure to pay the amount of goods and services tax to. If the late payment relates to an outstanding late-payment penalty relief is provided if 20 of the penalty is paid during 1 May.

October 2017 to April 2018. The penalty is also equal to the undercharged GST. Following to our previous newsletter on e-KTP 201549.

Page 3 of 11 be offset against output tax liability or added to the output tax liability of the subsequent months of the registered person. Late payment of tax during an assessment for YA 10 of the tax payable and. MALAYSIA GOODS e SERVICES TAX GST Royal Malaysian Customs Department.

The team of experts at our law firm in Malaysia can give you more information on remitting all of part of the late payment penalty. All groups and messages. Penalty on GST Late Payment Royal Malaysian Customs Department RMCD has officially announced with.

If the FORM GST TRAN-1 declaration has been filed on or before May 10 2018 then waived off completely. In accordance with amendments made to Section 41 of the Goods and Services Tax Act 2014 with effect from 112016 failure to pay the amount of goods and services tax to be paid within. Printed in Malaysia by SP-Muda Printing Services Sdn Bhd 906732-M 82 83 Jalan KIP 9 Taman Perindustrian KIP Kepong 52200 Kuala Lumpur.

Penalty on Late Payment. A late payment of 10 will be imposed on the balance of tax not paid after April 30 th May 15 th Individual. On 9 May 2017 the RMCD announced that registered persons that have been subject to a late payment penalty now may submit an appeal to the RMCD for remission of the penalty.

REMISSION OF LATE PAYMENT PENALTY UNDER SECTION 622 OF GOODS SERVICES TAX ACT 2014. The conditions include full payment of GST. Trying to leave the country without paying tax RM200 to RM20000 andor imprisonment.

When the late fee is accrued interest is. Omission of 6 GST on the disposal of fixed assets or trade-in of assets within Malaysia. Effective from 01 June 2018 do the GST registered persons need to pay any tax arrears and penalties even though they still have ITC claims that have not been approved by.

The day the overdue instalment amount and any accrued interest is paid. Paying GST via cheque near to the due date of a taxable period poses several risks. Tax Estimation Advance Payment.

Multiplying taxable purchases by 6 to arrive at the GST input tax amount. Penalty equal to the GST undercharged. The government has waived Rs 200 a day penalty on late payment of the Goods and Services Tax in a partial relief as taxpayers will still have to pay the interestLate fee for all.

32 Since the GST Council has decided that the. Relief from charging or payment of. From 01 June 2018 GST should be charged at standard rate of 0 on the difference.

Penalties General Offence. The Enforcement Division of the Royal Malaysian Customs Department RMCD has just announced that remission of late payment penalty will be considered for companies with.

Goods And Services Tax Gst Challenges Faced By Business Operators In Malaysia Topic Of Research Paper In Economics And Business Download Scholarly Article Pdf And Read For Free On Cyberleninka Open

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Malaysia Penalty Relief For Late Payment Of Gst Kpmg United States

Strategies In Dealing With Customs Audits And Disputes In Malaysia International Tax Review

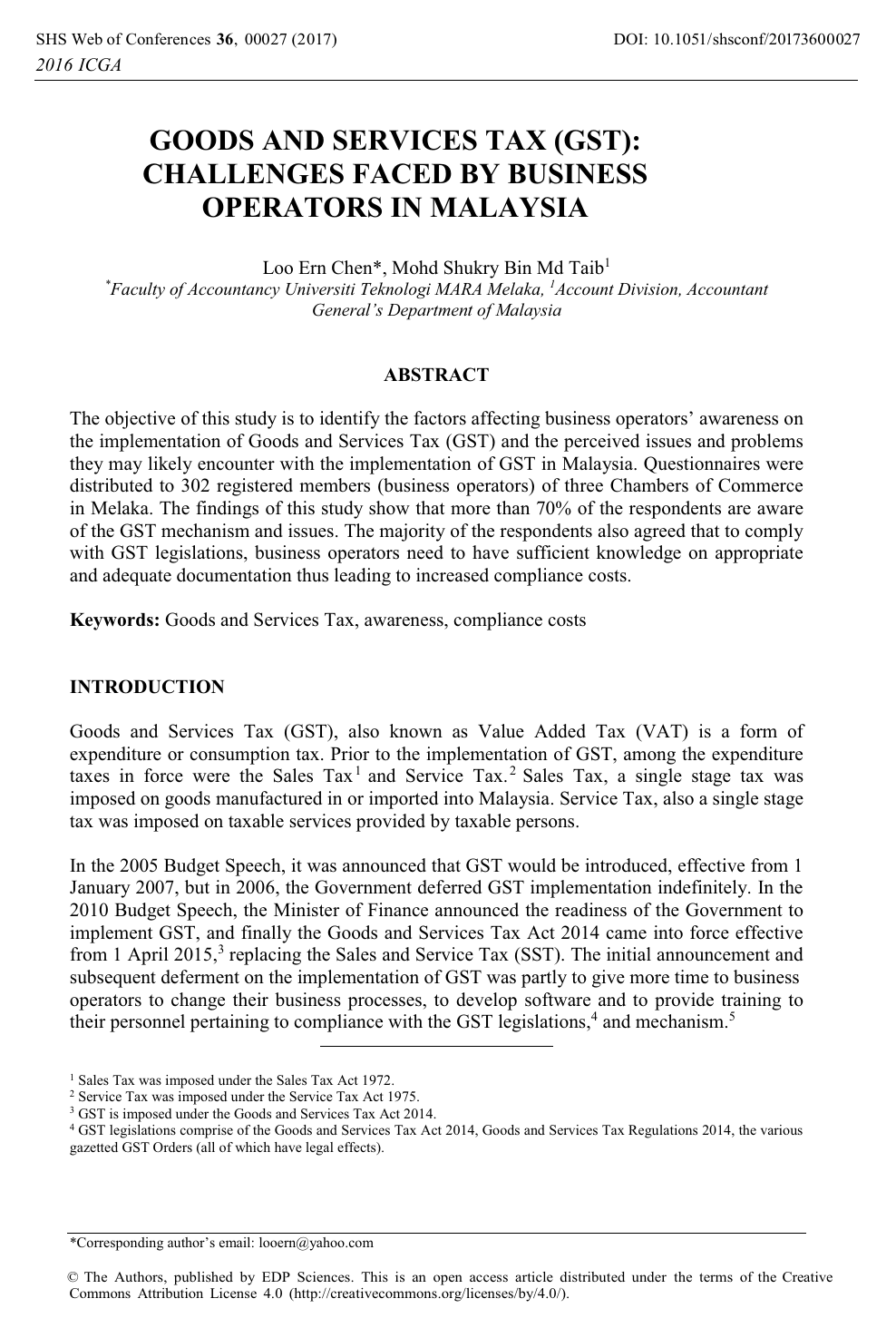

Maharashtra State Tax Department Explains Amnesty Scheme Allowing Waiver Up To 80 Of Tax Arrears Sales Taxes Vat Gst India

Gst Returns In 2018 Due Dates Requirements And Penalties

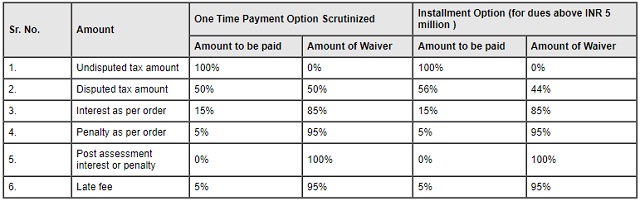

Standard Operating Procedure Sop For Scrutiny Of Returns For Fy 2017 18 And 2018 19 Sales Taxes Vat Gst India

Gst Return Is Not Filed What Happens Then Incorp Advisory

Gst Return Is Not Filed What Happens Then Incorp Advisory

Pdf The Readiness Of Small And Medium Enterprises Sme In Malaysia For Implementing Goods And Services Tax Gst